Semiconductors face high inventory pressure, industry players cut mature process production

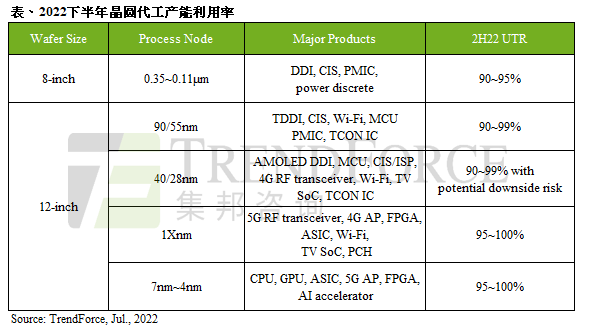

According to the Taiwan Economic Daily of China, semiconductors are facing high inventory pressure, and consumer electronics-related components based on mature manufacturing processes are the first to shrink their hands due to the huge inflation pressure. The round of foundry production volume has become a key factor affecting the market conditions of the foundry's mature process. According to reports, the high inflation pressure since the beginning of this year has led to a decline in consumption strength and a sharp drop in terminal demand. Panel driver IC manufacturers have taken the first shot at cutting wafer production for wafer foundries. Now MCU prices are collapsing simultaneously. Gradually reduce the amount of film cast. Previously, according to TrendForce's survey, wafer foundries experienced a wave of order cuts, and the first wave of order revisions came from large-size driver ICs and TDDIs, whose mainstream processes were 0.1Xμm and 55nm, respectively. Although MCU, PMIC and other products were still in short supply, the foundry's capacity utilization rate remained roughly at full capacity through product mix adjustments. However, the recent wave of PMIC, CIS and some MCU and SoC orders has emerged. , Although it is still dominated by consumer applications, wafer foundries have been unable to bear the large number of orders from customers, and the capacity utilization rate has officially declined. TrendForce pointed out that in the second half of the year, while the demand side continued to decline, consumer PMICs and CISs also began to adjust their inventory. Although there is still demand for PMICs and power discretes from servers, automotive, industrial control, etc. It is difficult to make up for the shortfall of driver ICs, consumer PMICs, and CIS, resulting in a decline in the capacity utilization rate of some 8-inch factories. TrendForce believes that the overall capacity utilization rate of 8-inch factories in the second half of the year will be roughly 90~95%. , some of which are fabs with a high proportion of manufacturing consumer applications, and may face a 90% production capacity defense war. According to TrendForce, looking at the trend of the second half of the year, apart from the continuous downward revision in the demand for driver ICs, there is no improvement. Peripheral components such as smartphones, PCs, TV-related SoCs, CIS and PMICs have also started to adjust their inventories and began to supply foundries. Decrease the production plan, and the phenomenon of order cutting occurred simultaneously in the 8-inch and 12-inch factories, and the process including 0.1Xμm, 90/55nm, 40/28nm, and even the advanced process of 7/6nm is not immune. Looking forward to 2023, TrendForce believes that after the shortage of chips for nearly two and a half years, the cooling of consumer products will loosen the capacity utilization rate of wafer foundries in the short term, but it has suffered from a single wafer in the past. Applications that are hard to find can be redistributed at this time. The penetration rate of related applications such as 5G smartphones and electric vehicles has increased year by year. Continue to support the foundry capacity utilization rate to remain above 90%, but some manufacturers that mainly produce consumer products may face the situation where the capacity utilization rate falls below 90%, at this time, they need to rely on the foundry itself Diversified layout and resource allocation for product applications to overcome the crisis of component inventory adjustment brought about by global high inflation.