In the semiconductor battle, we have won the AI chip nouveau riche!

The AI wave is sweeping across the globe, with a group of AI startups emerging like mushrooms after rain, and new technologies and products constantly emerging. Having overcome the investment boom of the previous two years, the AI nouveau riche is now facing a new financing crisis. At the same time, AI leading companies are eyeing more high-quality AI targets, aiming to quickly supplement their weaknesses and occupy a larger market share. A time tug of war is quietly unfolding between the emerging AI elites and the leading AI giants.

one

Global emergence of a wave of new AI elites, industry risks and opportunities coexist

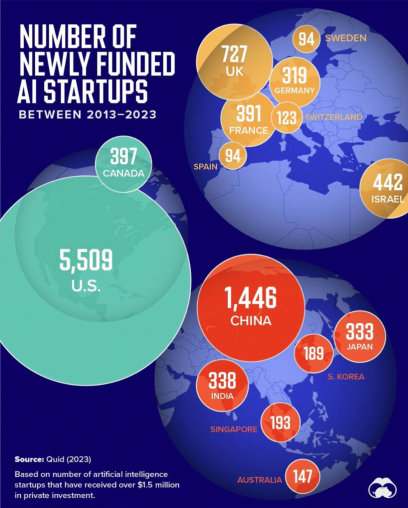

The AI wave is sweeping the world, and new AI elites are emerging like mushrooms after rain. Recently, global data visualization media Visual Capitalist produced a chart based on Quid's data from Stanford University's 2024 Artificial Intelligence Index Report, highlighting the 15 countries with the highest AI startup activity over the past decade.

Image source: Visual Capitalist

The numbers in the above chart represent the number of AI startups that received new financing in each country from 2013 to 2023, and only companies that received over $1.5 million in private investment were included in the statistics. The above data indicates that countries such as the United States, China, the United Kingdom, and Israel have become leaders in the global AI innovation field.

In terms of the situation in the United States, AI startups include big model company Reka AI, DPU rising star DreamBig Semiconductor, large-scale artificial intelligence, automated machine learning platform DataRobot, AI chip design startup Tenstorent, software and robotics startup Bright Machines, AI chip startup Etched.ai, training AI model rising star Scale AI, edge AI leader Blaze, artificial intelligence model startup Augment, AI assisted tool startup Cognition, silicon photonics innovation company Celestial AI, big model open source enterprise Together AI, and so on.

Under favorable policies and rapid market development in China, a group of AI startups have emerged from the encirclement. High quality targets include big model player SenseTime, Baichuan Intelligence, Zhipu AI, Fourth Paradigm, Minimax Xiyu Technology, etc., as well as artificial intelligence AIGC big model Zero One Thing, General Artificial Intelligence Research Month Dark Side, Multi modal big model enterprise intelligent sub engine, video production big model Aishi Technology, AI chip newcomer Aixin Yuanzhi, artificial intelligence visual technology enterprise Yingpu Technology, etc.

The UK has a long history in the field of AI and has built a rich ecosystem around it for decades. From Alan Turing's early work laying the foundation for the field of AI, to world-class research institutions driving the development of AI technology (such as Imperial College London, Cambridge University, University of Edinburgh, Oxford University, University College London), and the establishment of DeepMind in 2015, the UK has always been an important gathering place for AI talent. The profound history of AI research and top research institutions make the UK an important gathering place for AI talent. In recent years, the UK has seen the emergence of AI unicorn Wayve, knowledge graph startup Oxford Semantic, AI voice customer service company PolyAI, AI intelligent employee and software startup Artisan AI, and big model application startup Robin AI.

Israel's high-tech industry is well-developed, with AI startups including AI tool company AI21, AI chip star company Habana Labs, quantum chip company Quantum, high-performance microprocessor company NeoLogic, deep learning and AI solution architecture disruptor NeuReality, AI chip cooling revolutionary ZutaCore, and more.

However, for these AI nouveau riche, the market is fraught with crises. As for the United States, according to the Financial Times, the failure rate of AI startups has jumped by 60% in the past year. Despite billions of dollars in venture capital flowing into AI companies, the number of startup bankruptcies is still sharply increasing, as the funds raised by the founders of related AI companies during the 2021-2022 tech boom have already been depleted in recent years.

Not only American companies, but also global AI elites undoubtedly face the same dilemma. Industry financial investment professionals have stated that the influx of large amounts of funds in the short term has led to overvaluation of certain AI startups, but these companies are facing significant risks such as capital depletion, decreased investment returns, or market saturation. At present, market investors have become more cautious and are beginning to evaluate the long-term feasibility and profitability of AI startups, rather than investing solely based on their technological potential.

As we enter 2024, dark clouds have gathered over the AI nouveau riche, and a heavy rain is about to fall. The key is to compete for market financing and technological breakthroughs. At the same time, there are constant news of mergers and acquisitions in the industry, with top tier AI giants such as Nvidia and AMD making massive purchases, and competition in the AI industry gradually intensifying.

two

AMD Chases Dreams, Surpassing Nvidia

Based on AMD's official and performance reports, over the past year, AMD has invested more than $125 million in over a dozen AI companies, including Firework AI, AI data platform Scale AI, and more. In addition, AMD has acquired over seven AI companies such as Mipsology and Nod.ai to expand the AMD AI ecosystem, support partners, and enhance AMD's leadership position in computing platforms.

Recently, the company has made two major acquisitions - the $4.9 billion acquisition of server manufacturer ZT Systems and the $665 million all cash acquisition of Silo AI, Europe's largest private AI laboratory.

one

$4.9 billion acquisition of server manufacturer ZT Systems

On August 19th, AMD announced its intention to acquire server manufacturer ZT Systems for $4.9 billion through a combination of cash and stock. 75% of the payment will be made in cash, while the remaining amount will be paid in stock.

According to publicly available information, ZT Systems is the world's largest AI server manufacturer, headquartered in West Kaukas, New Jersey, with over 15 years of experience in designing and deploying data center AI computing and storage infrastructure for the world's largest cloud computing companies. Having rich expertise in AI systems, it can complement AMD chips and software functions.

It is reported that after the transaction is completed, ZT Systems will join AMD's Data Center Solutions business unit. ZT CEO Frank Zhang will lead the manufacturing business, while ZT President Doug Huang will lead the design and customer support teams, both reporting to Forrest Norrod, Executive Vice President and General Manager of AMD. At present, the transaction has received unanimous approval from AMD's board of directors, and the acquisition is expected to be completed in the first half of 2025, subject to approval from some regulatory authorities and meeting other closing conditions. In addition, AMD will seek strategic partners to sell ZT Systems' US data center infrastructure manufacturing business.

AMD stated that this acquisition will also help cloud and enterprise customers accelerate the large-scale deployment of AI infrastructure supported by AMD. It is reported that AMD can provide leading AI training and inference solutions based on cross chip, software, and system innovation. AMD expects that the transaction will add value to non GAAP revenue by the end of 2025.

It is worth noting that Nvidia has always been a customer of ZT Systems, which has provided AI services for GB200 GPU products, and the two companies are in an upstream downstream relationship. This means that after AMD's acquisition of ZT Systems is completed, Nvidia will lose its partnership with ZT Systems.

two

Acquiring Silo AI, the largest private AI laboratory in Europe

On August 12th, AMD announced the completion of its acquisition of Silo AI, the largest private AI laboratory in Europe, for a transaction value of up to $665 million, to be paid in full cash. This transaction will enhance AMD software performance and narrow the gap with competitor Nvidia.

Silo AI, known as the largest private AI laboratory in Europe, has its global headquarters located in Helsinki, Finland. Its business covers Europe and America, focusing on providing customized AI models and end-to-end AI driven solutions to help customers quickly integrate AI functions into their products, services, and operations. The laboratory has a world-class team of AI scientists and engineers, led by Peter Sarlin, a practical professor at Aalto University in Finland, Tero Ojanper, former Nokia CTO, Johan Kronberg, former CEO and Chairman of PwC, Ville Hulkko, co-founder of Valossa Labs' video AI platform, Kaj Mikael Bjrk, machine learning expert, Juha Hulkko, founder of Elektrobit, and others.

And the laboratory has also developed multiple cutting-edge AI models, platforms, and solutions, including open-source big language models such as Poro, Viking, and SiloGen, which are highly acclaimed in the industry. Silo AI's clients include large enterprise level clients such as Allianz Life, Philips, Rolls Royce, Unilever, etc. It is reported that more than 200 production level AI projects have been delivered so far.

AMD officially stated that this acquisition is an important step in AMD's strategy of providing end-to-end AI solutions based on open standards, and another manifestation of AMD's good cooperation with the global AI ecosystem. Silo AI will officially join AMD's Artificial Intelligence Division (AIG), led by AMD Senior Vice President VaMSI Boppana, to accelerate AMD's innovation and development in the AI field.

AMD has been committed to surpassing Nvidia in recent years. The industry has observed that AMD's development momentum has been fierce in the past two years. In the second quarter of this year, AMD's financial report was better than expected, and its artificial intelligence chip business revenue has exceeded $1 billion. On the other hand, Nvidia's revenue in the field of artificial intelligence fell short of expectations.

Industry insiders say that AMD is not without opportunities. Currently, AMD has launched the MI300X in the hardware field, which is considered comparable to the Nvidia H100 in certain tasks. In addition, AMD has promised to launch the MI325 with 288GB HBM3E memory this year and the MI350 next year, competing with Nvidia's Blackwell B200.

In terms of software, there is a significant gap between AMD and Nvidia, and the acquisition of Silo AI is crucial for AMD to address its software shortcomings. It is reported that Silo AI company trains its language model on Finnish supercomputers Lumi and AMD hardware, which is achieved through specially developed software layers.

Silo AI experts will further develop software in the future, which customers can use to program complex artificial intelligence models and train them on computers equipped with AMD chips. This specialized technology in the field of AI software is extremely valuable for AMD and its customers. AMD's acquisition of Silo AI not only brings top-notch AI technology and talent to AMD, but also greatly enriches its product line of AI solutions. In addition, Silo AI's customer base will bring more business opportunities and partners to AMD, helping it gain a larger share in the global AI market.

In the future, AMD's investment will continue to expand. Matthew Hein, AMD's Chief Strategy Officer, previously stated in an email that he hopes AMD Ventures' investment will further accelerate in 2024. In a recent announcement, AMD also stated that in addition to increasing research and development investment, the company has invested over $1 billion in the past 12 months to expand AMD's ecosystem and enhance the company's AI software capabilities.

three

NVIDIA invests heavily to continuously reinforce its moat

Nvidia has made significant investments in AI chip companies. Dealroom, a British consulting firm, has conducted a statistical analysis of Nvidia's primary market transactions in 2023. In 2023 alone, Nvidia invested in over 30 AI startups with a total financing value exceeding $5 billion. During the investment process, Nvidia did not seem to exclude any application scenarios, nor did it care about the number and size of target rounds. Whether it's upstream generic models, midstream enterprise SaaS, downstream To C vertical applications, or B and C round projects with billions of dollars in infrastructure construction for large models, or seed rounds with less than a million To Cs.

Since the beginning of this year, Nvidia has invested in over 17 AI companies, with two of the investments in rounds of financing totaling no less than $1 billion. In terms of acquisitions, Nvidia has successively acquired AI startups Run.ai and Deci. In addition, it also attempted to acquire Arm for a huge amount of $40 billion, but due to opposition from global regulators and market concerns, the deal ultimately ended in failure.

one

Acquisition of GPU orchestration software provider Run: ai

Public information shows that Run: ai was founded in 2018 and has developed an orchestration and virtualization software layer tailored to the unique requirements of AI workloads running on GPUs and similar chips. Based on Kubernetes' AI cloud container platform, Run: ai can achieve efficient GPU cluster resource utilization by automatically allocating necessary computing power. At present, the company has about 150 employees and has raised a total of $118 million in financing.

Nvidia stated that Run: AI has been a close partner of Nvidia since 2020. In the future, NVIDIA stated that it will continue to offer Run: ai products under the same business model and will continue to invest in the Run: ai product roadmap as part of NVIDIA DGX Cloud.

It is reported that NVIDIA DGX Cloud is an AI platform designed in collaboration with leading enterprise development clouds, providing integrated full stack services optimized for generative AI. NVIDIA DGX and DGX Cloud customers will have access to Run: ai's AI workload capabilities, particularly for deploying large language models. Run: AI's solution has been integrated with products such as NVIDIA DGX, NVIDIA DGX SuperPOD, NVIDIA Base Command, NGC container, and NVIDIA AI Enterprise software.

According to The Information, two people familiar with the transaction said that Run: AI's ability to improve AI chip efficiency may attract more customers to use NVIDIA DGX Cloud. Nvidia may offer Deci and OmniML technologies, as well as CUDA software, to make it cheaper for developers to build AI driven applications.

two

Acquiring AI big model enterprise Deci

Deci, another AI startup acquired by Nvidia, is also committed to achieving "cost reduction and efficiency improvement" in AI chips.

According to official information from Deci, Deci provides services to customers including Adobe and application materials. It adjusts the AI model to make it run cheaper on AI chips. It is reported that Deci initially assisted in enabling relatively simple AI applications on end devices such as mobile phones and cars, and then turned to self-developed large models to compete in the open source field. Its self-developed model has been uploaded to its website and Hugging Face community.

Last December, DeciLM's model ranked first in the Hugging Face ranking of models with 7 billion parameters, surpassing competitors such as Llama and Mistral in the open source field. But after Google launched its new Gemma model at the end of February, Deci lost its leading position. At present, Deci has reached cooperation agreements with multiple technology giants such as Microsoft, Intel, AMD, Amazon, etc.

three

Proposed acquisition of AI application super manager Shoreline.io

In addition, in June of this year, Nvidia announced its intention to acquire Shoreline.io, which is related to its semiconductor business. It is understood that the company was founded in 2019, focusing on improving the reliability and efficiency of cloud services. The IT infrastructure management and automation software developed by Shoreline.io can help enterprises automate the processing of events in cloud environments, effectively reducing the mean time to detect (MTTD) and mean time to repair (MTTR) of problems. Due to the above characteristics, Shoreline.io is known as the super steward of AI applications in the industry.

In addition, the cross cloud compatibility of Shoreline.io platform supports multiple cloud providers including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, providing a unified and efficient cloud environment management solution that can help enterprises manage and automate the deployment of applications and infrastructure on different cloud platforms. Through Shoreline.io's technology, it may help enterprises using Nvidia GPUs manage their cloud workloads more easily, thereby enhancing the attractiveness of Nvidia GPUs in the cloud. NVIDIA can also integrate more closely with major cloud platforms, promoting its GPU and software solutions to more users.

Conclusion

In addition to Nvidia and AMD, major players in various fields such as SoftBank, Google, and Microsoft have also made acquisitions and raised funds. SoftBank's recent acquisition of AI star company Graphcore has attracted industry attention. As a startup focused on AI chip research and development, Graphcore stands out in the fiercely competitive AI chip market with its unique IPU technology. Its valuation quickly climbed to $2.8 billion and was once seen as a weapon to compete with Nvidia, earning it the nickname of the 'British version of Nvidia'. Moreover, SoftBank recently announced its intention to invest $9 billion annually to increase its investment in artificial intelligence companies.

OpenAI announced two acquisitions in June, acquiring real-time analytics database startup Rockset and remote collaboration company Multi. In addition, Google's acquisition of Characterai, Microsoft's acquisition of the Reflection AI team, Thomson Reuters' acquisition of Casetext, the world's largest professional information service provider, and Thomson's acquisition of AI startup Casetext all reflect the rapid competition and development of the AI market.

In this tug of war over time, acquisitions are crucial for both top tier corporations and AI newcomers. The financing environment is becoming increasingly severe, and technological development requires time. "Devoting" to large enterprises has become the best second way out for new and wealthy enterprises, and even some AI startups are established and developed with the aim of gaining the favor of top large enterprises and being acquired by huge amounts. For top enterprises, the rapid development of AI makes it impossible to cover all aspects of the industry. Acquiring to make up for the shortcomings is the best choice. But overall, this is a tug of war over time, where the key lies in developing sustainable profit models, impressive technologies, and high-quality products as time passes.